October 2022 market overview: commerce and industry

Across the UK’s commerce and industry sectors, we’ve pulled together a review of the live data we have captured in October – London, Home Counties, West Midlands and South West England.

Stabilising vacancies

„The sectors consistently recruiting are in the technology, oil and energy, and retail space.“

Indicators are showing that we have now reached the end of the post-pandemic bounce. There are still a large number of vacancies and talent is still in demand but we have seen vacancies stabilise over the last three months.

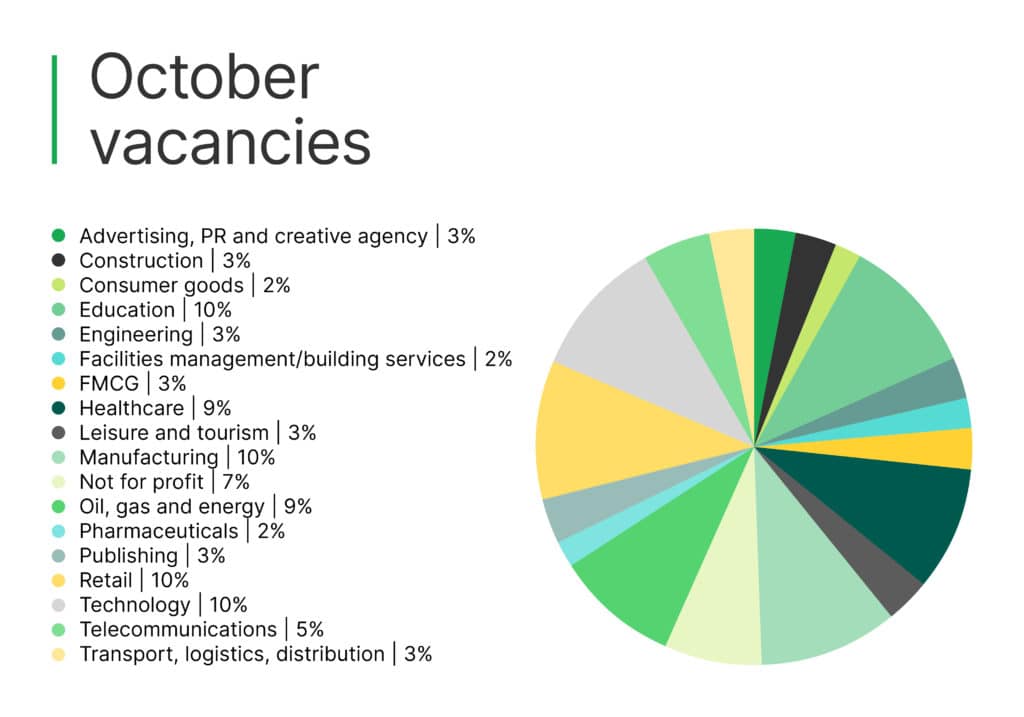

October was a steady month and similar to September in many ways. The sectors consistently recruiting are in the technology, oil and energy and retail space with 9% to 11% of market share of vacancies.

We have seen month on month increases in manufacturing from 3% to 10% and education from 4% to 10%. We saw a slight dip in PR, media, leisure and tourism all dropping down about 7%. These have all been minimal so nothing that would cause concern and there have been no major changes.

Longer processes continue

In September, we noted that processes were taking longer and we have continued to see this throughout October. We have also seen a slight rise in fixed term contract roles. This is because businesses are keen to hire contractors but to avoid over hiring when the market is unpredictable. To maximise on growth and productivity, they expect many of these roles to become permanent opportunities when the contract ends depending on the market.

Salaries aligning with the market

During the last month, we have also seen a decline in the recruitment of talent acquisition roles, again demonstrating how the market has started to stabilise in this area. While it experienced high growth in the first half of 2022, talent acquisition candidates are in less demand – aligning salaries with the market.

“November usually sets the market for January and the New Year.”

The generalist area, including Advisors, HR Business Partners and Head of/Director roles have been consistently strong month on month this year. We have also seen an uplift in payroll, reward and benefit specialisms with candidates in these areas still harder to find and secure.

Looking to the future

November usually sets the market for January and the New Year. It will be interesting to see if and how the market moves. When speaking to our network, we are also seeing how the cost-of-living crisis puts pressure on businesses to increase wages – and they are feeling that pressure. Saying that, many companies are still undecided on the majority’s annual pay rise the annual and are taking many factors into consideration before making decisions.

Watch this space for monthly commerce and industry updates.

If you’re looking to progress your career, reach out to me or contact one of our consultants today!